The Home Loan Process

Demystifying Home Loans

If you haven’t experienced it before, the home loan process can feel overwhelming, but our agents will help you stay informed throughout the process, from pre-approval to closing. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, we partner with some of the best lenders in the industry, and we’d be happy to introduce you, so you’ll be taken care of.

finance with

our lender

Bo Chalich

Loan Officer, Premier Lending, Inc

NMLS# 69896

- 509-710-1812

- bchalich@premierlending.com

About me: Bo is pleased to be a part of the Premier Lending residential lending team. With 20+ years of experience in the finance and mortgage industry, Bo specializes in placing his clients in the loan program that best fits their specific situation. Now more than ever, you need a family-oriented mortgage specialist who will work in your best interest when you make one of the biggest decisions of your life. Bo is experienced in Conventional, VA, FHA, construction, and Jumbo financing as well as first-time buyer programs. He really enjoys working with veterans on the financing of their homes. Bo strives to provide customers with straightforward, ethical, and honest service.

Bo was born and raised in this area and graduated from the University of Idaho. When he isn’t working, he likes to waterski, golf, and mountain bike. Bo is also involved in the community coaching youth basketball teams.

“I feel fortunate to be able to help my customers achieve their dream of home ownership. Give me a call with questions about purchasing or refinancing your home. I look forward to working with you.”

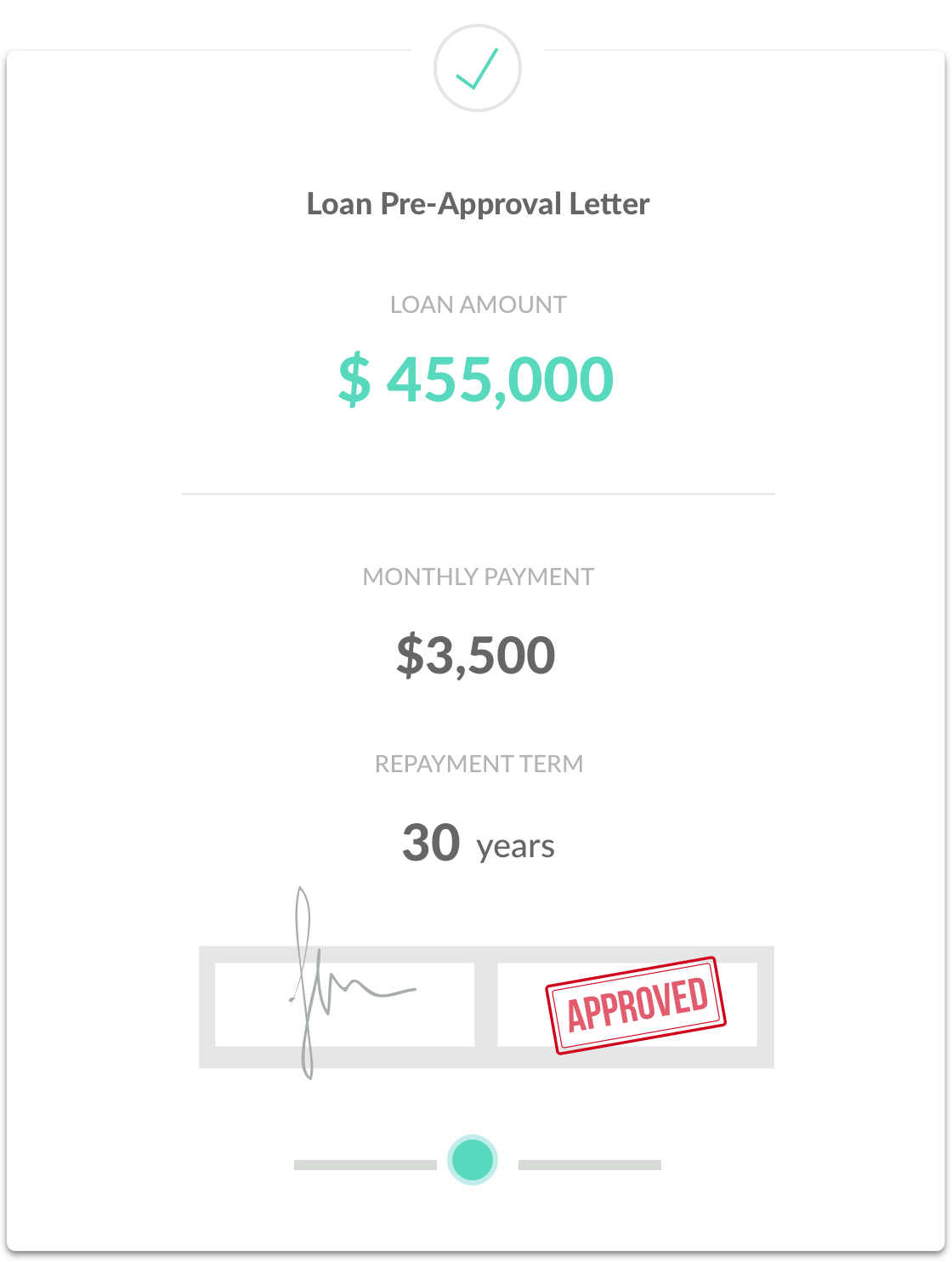

Let's Get StartedGet Pre-Approval

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

Application & Processing

What happens when a loan goes "live"

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Closing

Signing and Finalizing the deal

Don’t be surprised if you’re asked for additional documentation or clarification throughout the process. Once your loan is approved, don’t forget to set up homeowners insurance. Your documents will be sent to the title company, where you’ll sign for the new home and pay any remaining costs. Then the loan is recorded and you get the keys. Congratulations, happy homeowner!